Private Credit Infrastructure

for Emerging Markets

Originate, securitize, and service low dollar balance loans at scale using our permissioned protocol via API and web.

From Origination and Securitization to Repayment

$5.6M

Warehouse lines

$60M

Loans originated ($)

1.1M

Loans originated (#)

4

Partners onboarded

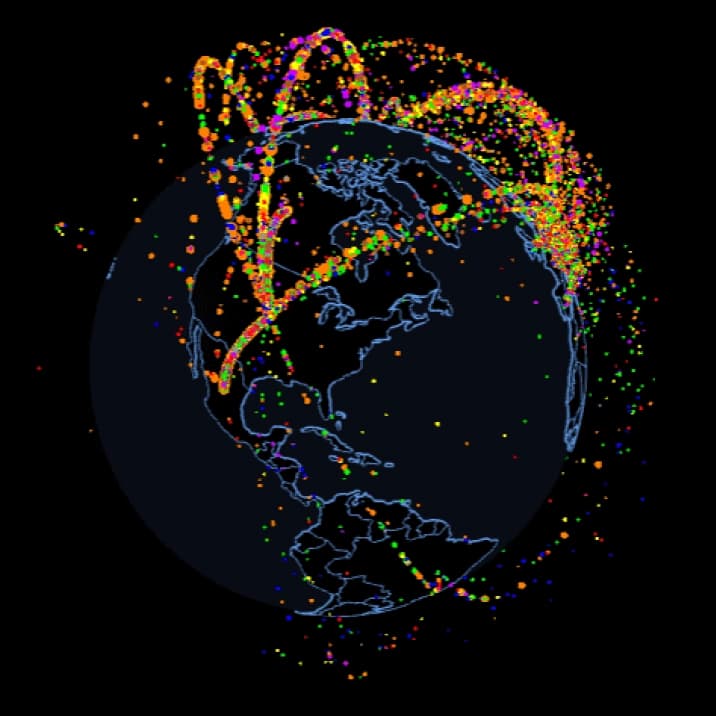

Merging the data agent and transaction execution layers

More than a database. Our core-ledger is built on high performance public blockchains enabling data-driven transaction execution.

Monitor loan-level data from our online dashboard

View your Collateral composition, approve funding requests, forecast cash-flow, and view loan-level data + covenants.

Finance originations in realtime using our loan tape API

Unlock realtime financing by using our API to upload loan-level origination requests that ensure covenants are met.

Create structured products with our securitization tools

Leverage our SPV templates to create ABS products like junior, senior, and mezzanine positions.

Automate repayment forwarding and waterfalls

Reduce counterparty risk and settlement times by taking payment in FIAT-backed stablecoins.

Supported Instruments & Vehicles

Leverage our templates to reduce startup costs

Consumer Credit

Warehouse Lending

Forward Flow Financing

Asset Securitization

SPV Templates